You may be able to do this utilizing any unused funds in the student’s 529 Plan. The IRS now allows rollovers of these funds to a Roth IRA in the child’s name.

REQUIREMENTS

You must have owned the 529 account for at least 15 years before rollovers are allowed. Contributions made in the five years before distributions start–including the associated earnings–are ineligible for a tax-free rollover. Rollovers can’t exceed the 2024 annual Roth contribution limit ($7,000/$8,000 for ages 50 and older).

The lifetime 529 rollover limit is $35,000, so you’d have to do a rollover annually for several years. As the owner of the Roth IRA, your graduate must have earned income at least equal to the amount of the annual rollover.

THE MILLIONAIRE PART

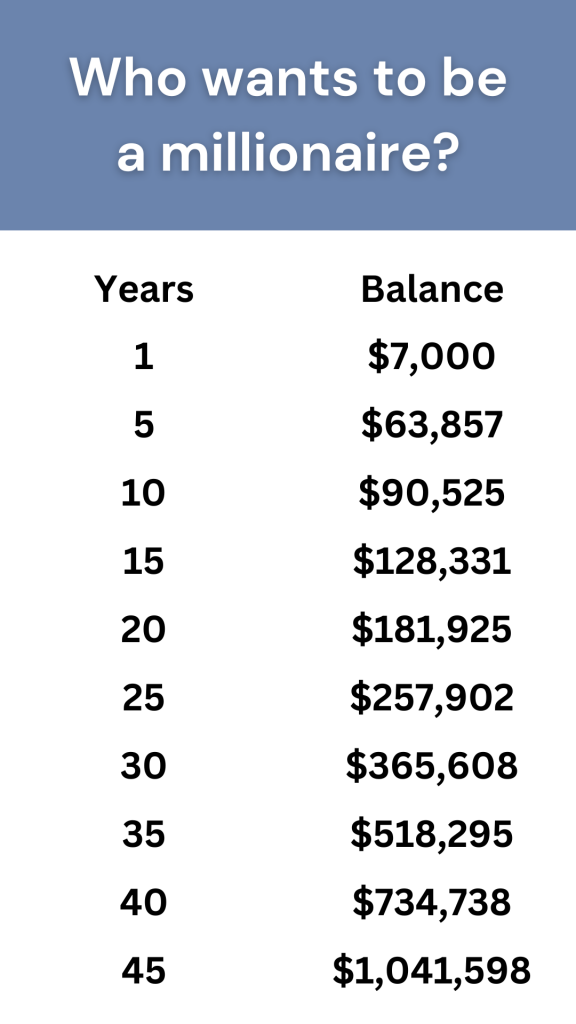

Look at the hypothetical example (chart) of making rollovers of $35,000 in remaining funds over five years. It assures the annual contribution limit remains $7,000, your child makes no additional contributions, and the IRA earns a hypothetical 7% compounded interest monthly for 45 years.

You started this 529 plan to help your student get ahead. Now that they are done with school, keep them moving in the right direction financially. Call us to discuss your unique situation.