Bonus depreciation is a valuable tax incentive that allows businesses to recover the costs of qualifying assets quicker than traditional depreciation methods. Introduced as part of various tax reforms, bonus depreciation has emerged as a powerful tool for stimulating investment and boosting economic growth.

Here’s how it works.

This method of accelerated depreciation allows businesses to take an additional deduction of 80% of the cost of qualifying property in the first year it’s put into service. This deduction applies to new and new-to-you equipment, providing flexibility in claiming tax benefits.

Before 2023, you could deduct 100% of the cost. But the current provision allows 80% to be deducted immediately, with the remaining amount spread out over the asset’s useful life.

This special deduction allowance is an additional deduction you can take after you take the Section 179 deduction and before calculating regular depreciation for the year.

There are qualifications and restrictions.

To qualify, the deduction must be first used in the same year you claim the initial depreciation deduction.

Only certain types of property may be eligible for bonus depreciation. The item must be:

- owned by the business

- used in your business or income-producing activity

- usable for a determinable lifespan (generally less than 20 years)

- expected to last more than one year

Also, if you opt for bonus depreciation for one of your company vehicles, you must apply it to all your vehicles. Unlike Section 179 depreciation, you cannot selectively choose which vehicles to include. This ensures consistency in the treatment of assets when claiming bonus depreciation.

What it means for business.

Claiming bonus depreciation for your business can be a beneficial strategy for reducing your taxable income. It can even create a taxable loss, a significant advantage that sets it apart from Section 179 depreciation.

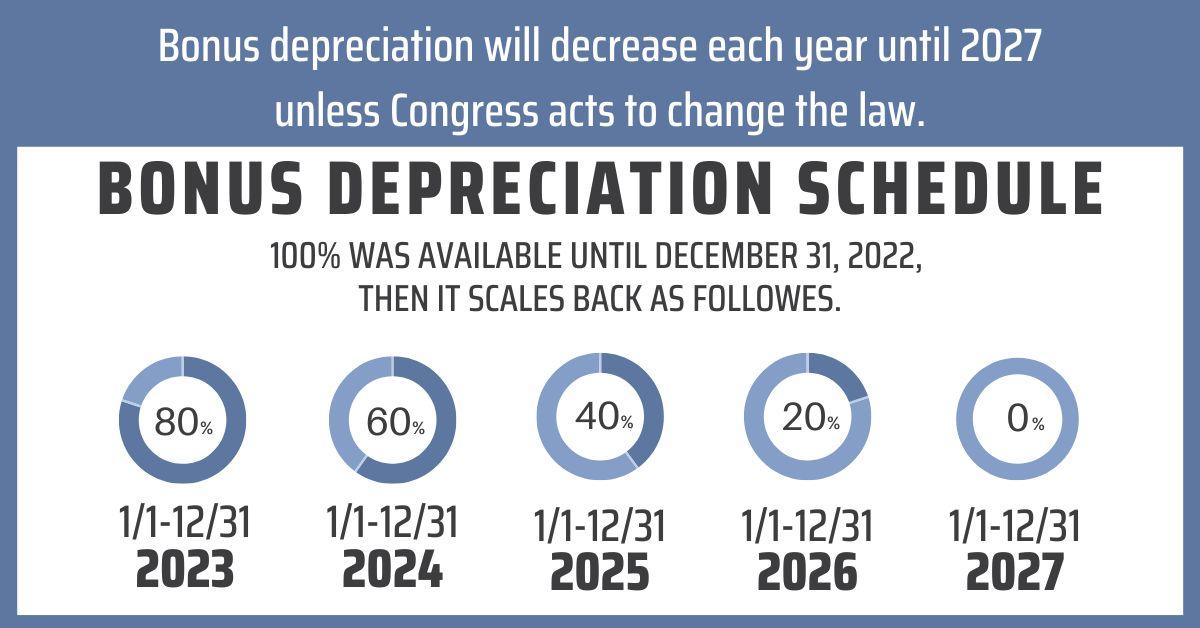

Beware that bonus depreciation will phase out to zero effective January 1, 2027. (See graph below.)

By taking advantage of bonus depreciation, businesses can offset their taxable income more effectively, potentially resulting in substantial tax savings. This makes bonus depreciation a valuable tool for companies aiming to optimize their financial outcomes and minimize their tax liabilities.

As a business owner, it’s essential to consider bonus depreciation as part of your tax planning initiative and optimize your financial outcomes.

Let Boris Benic and Associates help you explore this tax-saving strategy.