by Boris Benic | Jan 15, 2019 | Blog

January 15, 2019

While most provisions of the Tax Cuts and Jobs Act (TCJA) went into effect in 2018 and either apply through 2025 or are permanent, there are two major changes under the act for 2019. Here’s a closer look.

(more…)

by Boris Benic | Jan 8, 2019 | Blog

January 8, 2019

The dawning of 2019 means the 2018 income tax filing season will soon be upon us. After year end, it’s generally too late to take action to reduce 2018 taxes. Business owners may, therefore, want to shift their focus to assessing whether they’ll likely owe taxes or get a refund when they file their returns this spring, so they can plan accordingly.

(more…)

by Boris Benic | Jan 2, 2019 | Blog

January 2, 2019

Retirement plan contribution limits are indexed for inflation, and many have gone up for 2019, giving you opportunities to increase your retirement savings:

- Elective deferrals to 401(k), 403(b), 457(b)(2) and 457(c)(1) plans: $19,000 (up from $18,500)

- Contributions to defined contribution plans: $56,000 (up from $55,000)

- Contributions to SIMPLEs: $13,000 (up from $12,500)

- Contributions to IRAs: $6,000 (up from $5,500)

(more…)

by Boris Benic | Dec 26, 2018 | Blog

December 26, 2018

Do you have investments outside of tax-advantaged retirement plans? If so, you might still have time to shrink your 2018 tax bill by selling some investments you just need to carefully select which investments you sell.

(more…)

by Boris Benic | Dec 24, 2018 | Blog

December 20, 2018

In the past, online retailers were only required to collect state and city sales tax in states where they had a physical presence, such as a warehouse, employees, or an office. But earlier this year, the Supreme Court changed everything for e-commerce companies when they upheld a law permitting states to charge sales tax to out-of-state sellers, regardless of whether or not a business has a physical presence in that state.

(more…)

by Boris Benic | Dec 18, 2018 | Blog

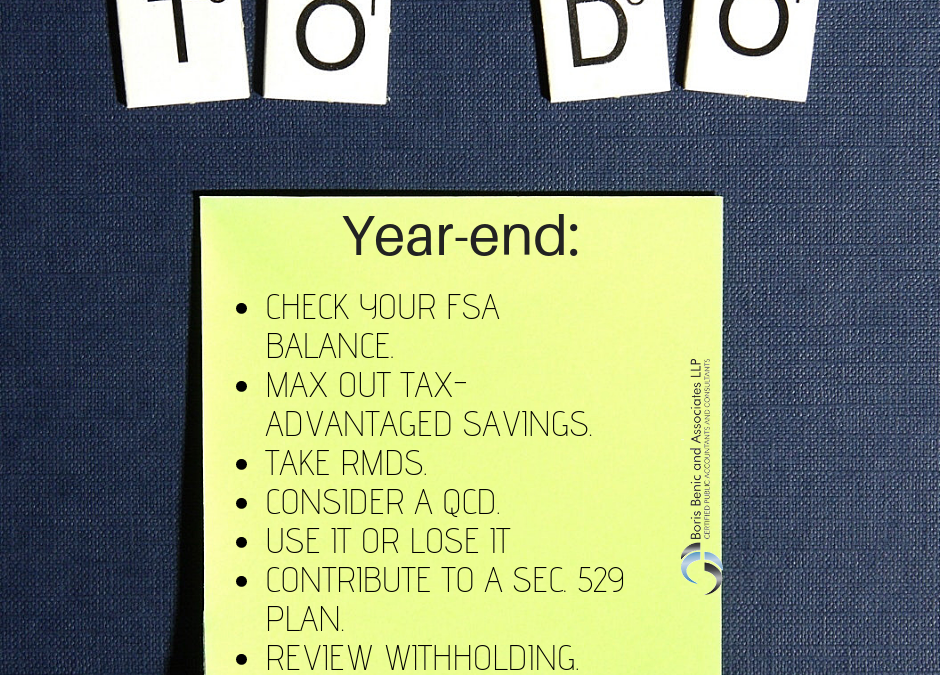

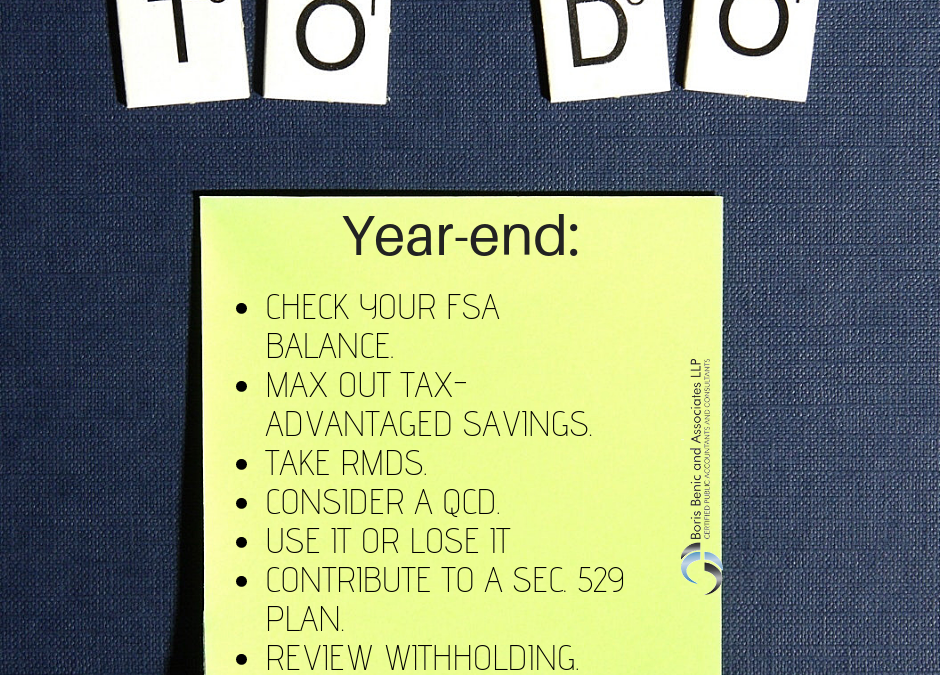

December 18, 2018

With the dawn of 2019 on the near horizon, here’s a quick list of tax and financial to-dos you should address before 2018 ends: (more…)