by Boris Benic | Dec 11, 2018 | Blog

December 11, 2018

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2019. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements.

(more…)

by Boris Benic | Dec 4, 2018 | Blog

December 4, 2018

Prepaying property taxes related to the current year but due the following year has long been one of the most popular and effective year-end tax-planning strategies. But does it still make sense in 2018?

(more…)

by Boris Benic | Nov 29, 2018 | Blog

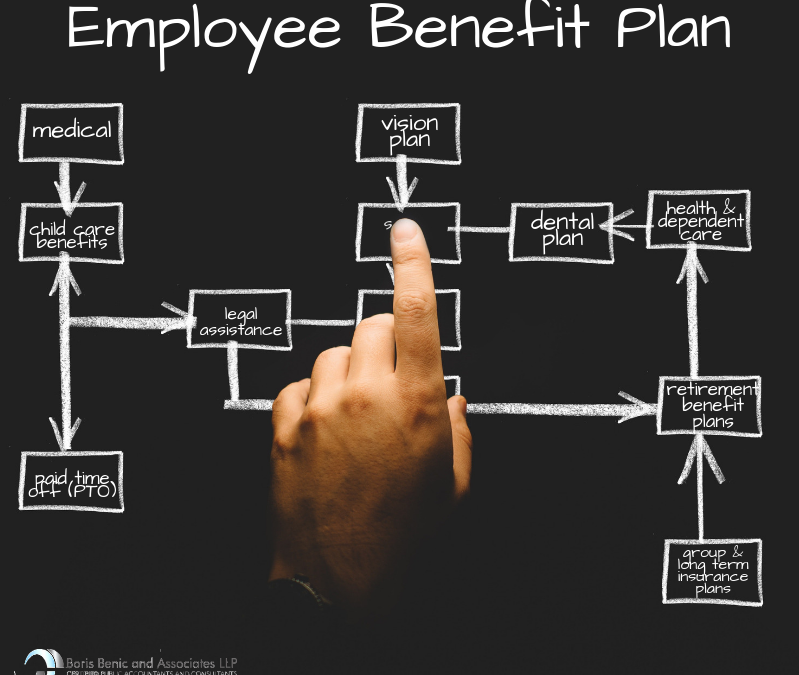

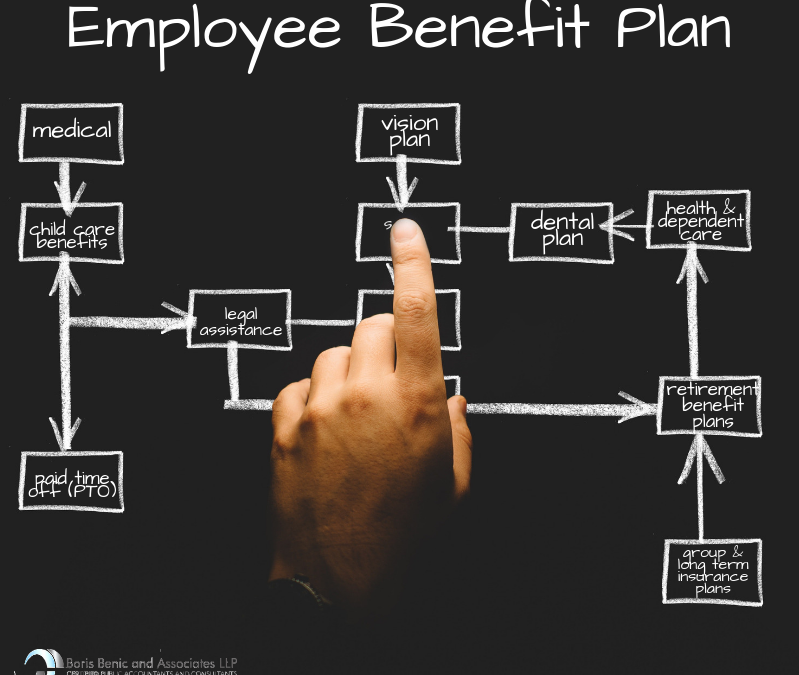

In 2015, the Employee Benefits Security Administration reported that 39% of annual audits of plan financial statements contained major deficiencies to one or more applicable requirements. The rules for employee benefit plans audits are complex, which is why the importance of hiring experienced employee benefit plan auditors cannot be understated. (more…)

by Boris Benic | Nov 27, 2018 | Blog

November 27, 2018

Will you be age 50 or older on December 31? Are you still working? Are you already contributing to your 401(k) plan or Savings Incentive Match Plan for Employees (SIMPLE) up to the regular annual limit? Then you may want to make “catch-up” contributions by the end of the year. Increasing your retirement plan contributions can be particularly advantageous if your itemized deductions for 2018 will be smaller than in the past because of changes under the Tax Cuts and Jobs Act (TCJA).

(more…)

by Boris Benic | Nov 20, 2018 | Blog

November 20, 2018

As we approach the end of 2018, it’s a good idea to review the mutual fund holdings in your taxable accounts and take steps to avoid potential tax traps. Here are some tips.

(more…)

by Boris Benic | Nov 13, 2018 | Blog

November 13, 2018

The Tax Cuts and Jobs Act (TCJA) has enhanced two depreciation-related breaks that are popular year-end tax planning tools for businesses. To take advantage of these breaks, you must purchase qualifying assets and place them in service by the end of the tax year. That means there’s still time to reduce your 2018 tax liability with these breaks, but you need to act soon.

(more…)