Start Your College Grad On The Path To Becoming A Millionaire

You may be able to do this utilizing any unused funds in the student’s 529 Plan. The IRS now allows rollovers of these funds to a Roth IRA in the child’s name.

(more…)

You may be able to do this utilizing any unused funds in the student’s 529 Plan. The IRS now allows rollovers of these funds to a Roth IRA in the child’s name.

(more…)

Do you want to save more for retirement on a tax-favored basis? If so, and if you qualify, you can make a deductible traditional IRA contribution for the 2018 tax year between now and the tax filing deadline and claim the write-off on your 2018 return. Or you can contribute to a Roth IRA and avoid paying taxes on future withdrawals.

August 14, 2018

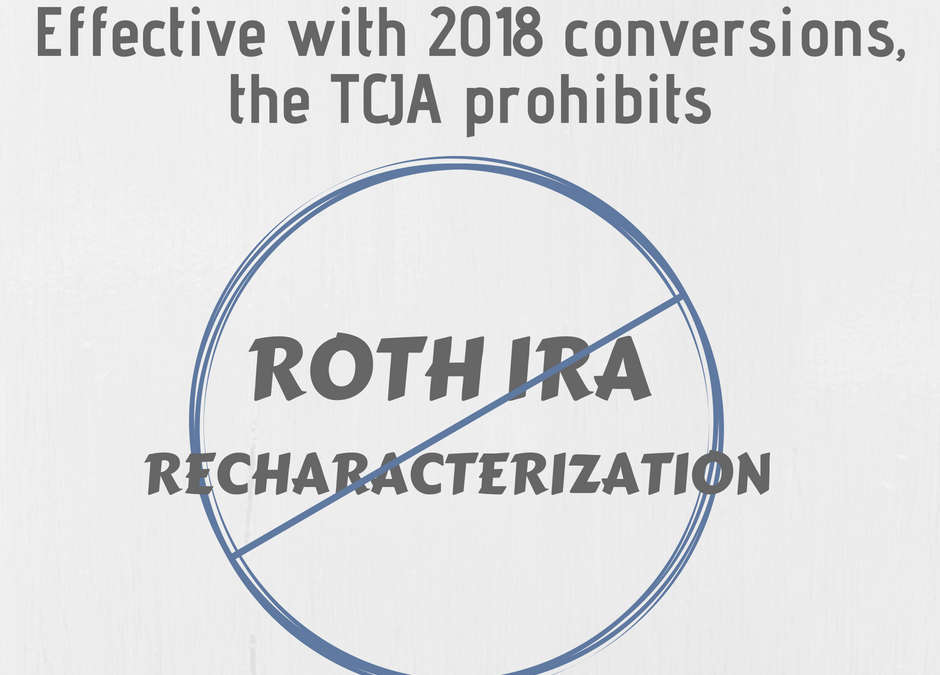

Converting a traditional IRA to a Roth IRA can provide tax-free growth and tax-free withdrawals in retirement. But what if you convert your traditional IRA — subject to income taxes on all earnings and deductible contributions — and then discover you would have been better off if you hadn’t converted it?

September 26, 2017

One important step to both reducing taxes and saving for retirement is to contribute to a tax-advantaged retirement plan. If your employer offers a 401(k) plan, contributing to that is likely your best first step.

If you’re not already contributing the maximum allowed, consider increasing your contribution rate between now and year end. Because of tax-deferred compounding (tax-free in the case of Roth accounts), boosting contributions sooner rather than later can have a significant impact on the size of your nest egg at retirement.

A traditional 401(k) offers many benefits: (more…)

August 29, 2017

Converting a traditional IRA to a Roth IRA can provide tax-free growth and the ability to withdraw funds tax-free in retirement. But what if you convert a traditional IRA — subject to income taxes on all earnings and deductible contributions — and then discover that you would have been better off if you hadn’t converted it? Fortunately, it’s possible to undo a Roth IRA conversion, using a “recharacterization.” (more…)